Product Goals

Encourage users to use already booked FX

We don’t want our users to have to pay booking fees due to our system’s lack of error prevention or double-book their FX. We want to reduce frustration with the product and the bank.

Make it easier for users to keep track of their FX

We want to ensure that our users are aware of their payments, FX trades and the linkages between these two segments.

Be updated visually

The FX Centre has to get with the times and be created with the new design system in place.

Core User Needs

Initiate

A user in our platform has to be able to create an FX or a payment that needs an FX.

Authorise

For payments to go through, some of our personas need to be able to approve it in a timely manner to avoid fees.

Manage

Power users such as managers must be able to use the FX centre without needing authorisation.

Google analytics: Data payments with FX

12 month analysis - (1 March ’24 – 31 March ’25)

Overview

Current state: Different options provided in the application to link payments and FX

-

Clients book FX > Manage FX > Link FX to payments

-

Clients who book FX > Use prebooked transactions

-

Clients who choose FX as part of payment journey

-

Payment Authorizer actions

Overview

To understand how different options for linking FX & Payments are used by clients in general over a time period of 12 months (March 2024 – March 2025)

Overall usage of FX Menu

Top Groups utilising the FX Request for Quote functionality are high-value Gold and Silver tier clients

The new Unassign FX Rate feature has seen low user activity count over the last 12 months; however, consistent MoM usage

Overall usage of FX Options

Overall, Live FX options have more users and clicks (total events) than Bank Rate

RFQ at Send to Bank and Pre-Booked Rate are the highest used FX options in the last 12 months

MoM Usage of FX options

Request For Quote at Send to Bank has a significantly higher volume of users compared to the other FX options

Nov 2024 has seen highest usage of RFQ at Send to Bank in last 12 months

Research Insights

Double-booking can happen in both flows

Based on flow analysis a double booking can happen both in payment and FX booking flow.

Payment flow

If payment is declined, the associated FX contracts is still on hold. A client may initiate payment with a new FX contract instead of using the existing one.

FX Centre flow

The current product doesn't make the existing FX contracts stand out if the economics of current FX being booked is the same as already existing contracts.

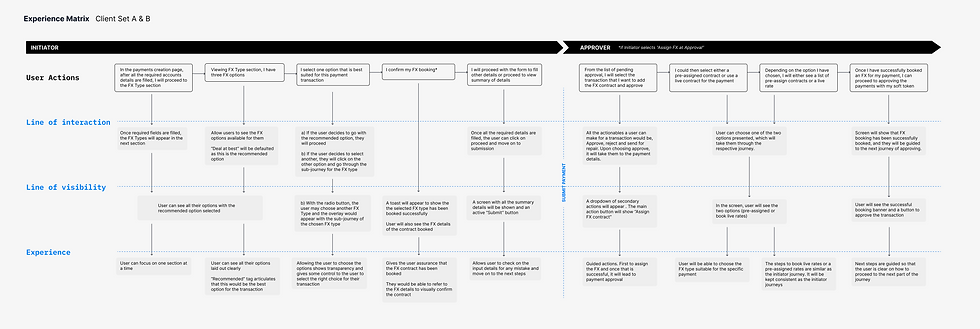

Personas and Tasks

RFQ user

The Request-for-Quote (RFQ) user is responsible for

making sure that FX contracts booked are used.

Book an RFQ

-

Select rate

-

Select the value date

-

Select account

-

Select counterparty/entity

-

Select proof of underlying document

Link FX trade to a payment

-

Select payment to link

-

Select the FX contract to link

Payment initiator

The Payment Initiator is responsible for choosing

the correct FX option on the payment screen.

Create a new payment

-

Select an FX contract for the payment

-

Ask another user to book an FX for the payment

-

Must book an FX transaction (in some cases)

--

--

Payment authoriser

Payments authorises are responsible for

approving transactions.

Authorise payment

-

Review and approve the payment and the FX linked to it

Book an FX

-

Select rate

-

Select the value date

-

Select account

-

Select counterparty/entity

-

Select proof of underlying document

Phase 1

FX Centre

Book, approve, and manage FX contracts

Objective

Users can keep track of their active transactions, and they can request a quote for their upcoming transactions which require currency exchange

Task

HIgher Level Tasks - The Finance Manager wants to book/approve a FX from FX Centre

Lower level task - Monitor, sort and utilise FX contracts

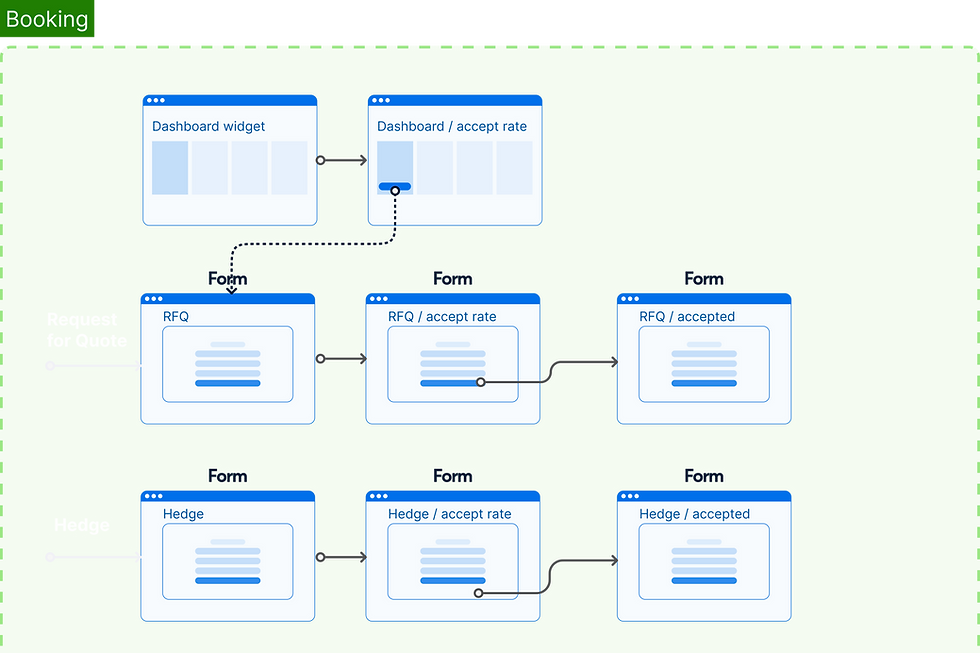

Understanding the FX booking ecosystem

Request for Quote

One of the ways to book an FX. This method involves a 15-second timer to accept a rate. It shows only the value dates for Today, Tomorrow, and Spot (day after tomorrow).

Hedge booking

This method involves executing streaming rates that display the bid and ask prices. It shows a value date picker and tenors.

Creating a request for quote: RFQ

Creating a hedge contract

Approving RFQ / Hedges, Rollover & cancellation requests

Creating a rollover request for FX contracts nearing maturity

Creating a cancellation request for FX contracts

PoU (Proof of underlying)

Mandatory for restricted markets to book large scale FX transactions

Phase 2 (W.I.P)

Utilise FX Contracts

Use exsisting or add new contracts for a payment transaction

Objective

Users can continue to use their already booked/active FX contracts for international payments

Task

Higher Level Tasks - Book an FX while making a telegraphic transfer, trade & settlements

Lower-level task - determine spot dates and Deal@best (SCB Bank rates) for FX bookings

Understanding the FX utilisation ecosystem

Utilising FX

You can utilise your approved FX contracts when making a transaction, settling a trade invoice, or receiving an inward telegraphic transfer. A pre-booked FX contract can be utilised instantly without needing any further bank approval

How to get the best deal on your FX

The FX utilisation while making payments provides multiple options to choose from to get the best deal rate 1. user can utilise their existing contract which will give the deal rate similar to their exposure type, 2. they can opt for bank rate 3. they can request for a deal rate assigned to when th e payment it cleared or 4. they can create an instant spot FX booking accepting the current rate for that day